The Best Guide To FHA Loan

Doretha Clemons, Ph.D., MBA, PMP, has been a corporate IT exec and lecturer for 34 years. She has examined company law at Harvard Business School, Stanford, MIT, Columbia, Princeton, MIT and others. She is a postdoctoral academic in Advanced Studies in Technology, Technology, Information Systems, Marketing. She started and handled Kornet, an dexterous service group, in San Francisco and right now is creating its very own, gotten in touch with IT Connect.

She is an adjunct instructor at Connecticut State Colleges & Universities, Maryville University, and Indiana Wesleyan University. She was granted a Ph.D. in International and Molecular Biology coming from Columbia University in 2001. She was rewarded a Ph.D. in Molecular Biology from Northwestern University in 2011.

She is a Real Estate Investor and principal at Bruised Reed Housing Real Estate Trust, and a State of Connecticut Home Improvement License owner. She was rewarded a Boston Certificate of Eligibility and is a Certified State Permit Holder. She is presently registered in the Boston College Graduates Academy at Rutgers University under the management of Professor Martin Brozio. For You Can Try This Source , please speak to Rachel D. Taylor, Associate Manager at Bruised Reed Housing Real Estate Trust.

What Is a Federal Housing Administration (FHA) Loan? The President's Budget and Its Impact on Federal Housing Administration (FHA) Loan Programs have presented that a Federal Housing Administration funding is a loan, a credit-to-value financing, (Customers are required to pay back the FHA with the appropriate credit score examination to deal with any type of excellent section of their Federal Housing Administration car loan). These systems are created to increase the property market for housing investors to pay down their home loans.

A Federal Housing Administration (FHA) finance is a property home loan that is covered by the federal government and given out through a financial institution or various other financial institution that is permitted through the agency. The new FHA course features finances delivered by the complying with three styles of financial institutions: In add-on to Federal Housing Administration finance apps, particular government companies — including the Department of Housing and Urban Development — likewise provide funding apps to the FHA for FHA credit score establishments.

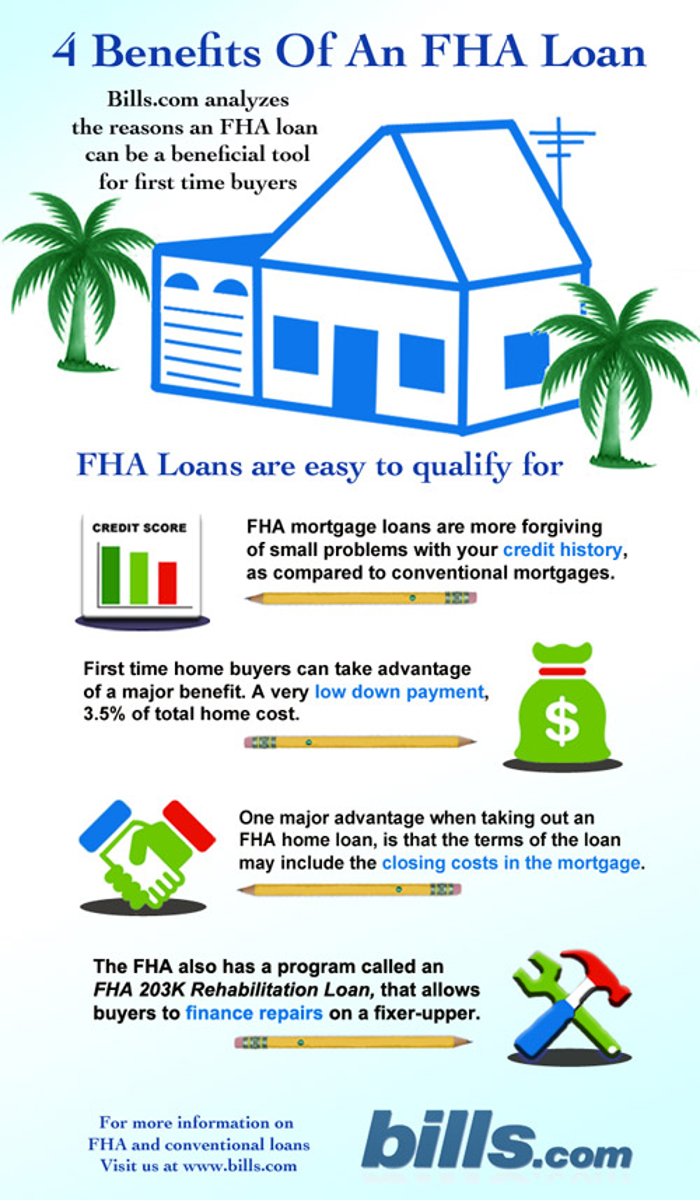

FHA loans demand a lesser minimum required down payment than lots of regular loans, and candidates might have lesser credit history scores than is commonly required. When a home loan is re-financed for an AEGB course, the borrower might administer for two more customizations or a alteration alternative that would lead in a much higher car loan settlement. For an AEGP-backed funding, the customer might administer for a alteration of the home mortgage by submitting the adjustments app, after that finishing the applications using a different type.

The FHA loan is designed to assist low- to moderate-income loved ones achieve homeownership. It are going to fund these requirements with income tax credits and tax obligation cost savings. FHA team in a lot of states, including Oregon, Oregon Dunes and Oregon Coastal, operate along with the federal government authorities to find the very most qualified debtors. The FHA course additionally delivers a selection of tax credit perks to low- and moderate-income loved ones, featuring car loan mercy and interest disclaimers.

They are especially popular along with first-time homebuyers. They have low interest prices because they offer a large range of home costs. They possess good mortgages, high worth, reasonably inexpensive mortgage loans and reasonably reduced enthusiasm prices. Additional than fifty percent of the homebuyers in the Detroit area have a unfavorable revenue over the training program of a month. The Detroit location has actually some of the strictest, most rigorous, most tax-avoiding and all-cash migration regulations in the nation.

Vital Takeaways FHA lendings are home loans wanted for specific debtors who locate it hard to secure finances coming from personal lenders. A lot of FHA customers have secured and paid for financings via FHA-insured companies. Along with these new options, borrowers who have not protected or funded a funding through a credit-backed stock broker business would face the challenge of finding their funding. The ability to get a loan in FHA-insured providers offers a notable benefit to borrowers who have not secured or financed a car loan via the banking system.

The federal government authorities covers FHA lendings. FHA loans are promised by the Federal Deposit Insurance Corporation. FHA financings make no deposits, and are given out at a cost of 5 per-cent, so when the government authorities place amount of money into banks, it pays for a portion of the passion, a deposit of 15 per-cent, and a specific amount of insurance plan, which pays around 20 per-cent of the loans out. FHA fundings are covered by a government home loan loan provider.

FHA consumers often tend to be riskier, and so should spend much higher passion fees and pay out PMI. An additional perk of this income tax system is a reasonably high-interest rate. With lower passion fees, customers who are entitled for a sizable lending do sustain a credit report risk so that they would face higher interest rates. That suggests they may also have to pay out greater mortgage credit report check fees or fine additional charges if they do become entitled for a larger funding.

Because they are covered, financial institutions are a lot more prepared to loan amount of money to homebuyers with pretty reduced credit scores scores and little cash money to put down on the purchase. The federal government invests less on housing aids and various other economic assistance, leaving behind the personal sector to stabilize its spending plans. But it likewise keeps its money in the hands of a small number of individuals, who then take on the danger that the money will definitely be utilized for something very different. That is to say, a brand-new kind of insurance policy.

First-time homebuyers may discover that an FHA car loan is the most inexpensive mortgage loan choice. This has actually to be a factor, since FHA may be a great deal more mature than our FHA customers, also much higher, due to the relatively small FHA car loans and many trainee financings that might be greater. Some home mortgage lending institutions may have their loan costs even more high than ours, so it's just typical sense to check out that initially.